Giving Options

Philanthropy is essential to sustaining a vibrant community.

Giving Options

We accept cash donations as well as a variety of other assets.

We can help you understand the benefits of different types of gifts and the most effective way to apply them. And we are flexible – if you have ideas of your own, please inquire. We are here to make sure your giving makes an impact.

Mail your check payable to Community Foundation of Jackson Hole and note in the memo line which fund you would like to support.

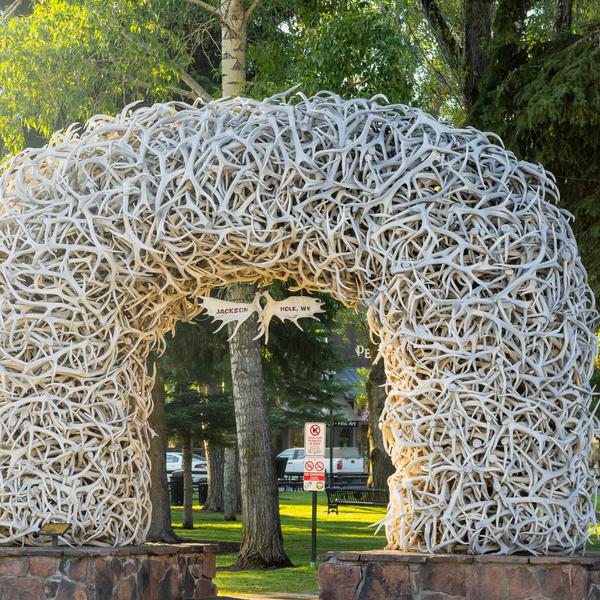

Community Foundation of Jackson Hole

P.O. Box 574

Jackson, WY 83001

Search or browse through our funds accepting public donations and give by credit card any time. A 2.4% processing fee will be charged for credit card donations.

We accept most types of gifts including the following:

- Bonds

- Business Interests

- Estate assets

- Life insurance

- Mutual fund shares

- Oil and gas, mineral or timber rights

- Private securities

- Publicly traded securities

- Real property

- Retirement assets (IRA, retirement plans)

- Tangible personal property

- Trust assets

If you have questions about assets or would like to see our gift acceptance policy, please contact us.

Open A Fund

We manage several types of funds at the Community Foundation.

The Community Foundation offers Donor View, a secure online tracking system that lets fundholders view fund activity and recommend grants online 24⁄7 as a service to our fundholders.

Here are a few of our fund options:

- Donor Advised Funds can be considered a charitable checking account. We are uniquely positioned to support your gifting with donors advised funds, and our team is integrated into the Jackson Hole community and eager to learn your giving preferences.

- Agency Funds are funds specifically for the nonprofits here in Jackson Hole.

- Memorial Funds are funds set up in memory of a loved one. See our current memorial funds here.